A seismic shift is rippling through the rarefied world of luxury timepieces. In an unprecedented move, wealthy American collectors and retailers are snapping up Swiss watches at a feverish pace, driven by looming tariffs announced by former President Donald Trump. As the U.S. government threatens to slap steep levies on iconic Swiss brands like Rolex, the rush to secure these coveted status symbols has reached a crescendo, fundamentally reshaping the global dynamics of luxury consumption—at least for now.

The Anatomy of a Surge: What’s Behind the Swiss Watch Frenzy?

April was a record-breaking month for Swiss watchmakers exporting to the United States. According to the Federation of the Swiss Watch Industry, exports to America soared by nearly 150% compared to the same period last year. This extraordinary leap was not the result of a sudden, organic uptick in consumer passion, but rather a calculated response to uncertainty. The U.S. remains the world’s largest market for Swiss watches—a market that now finds itself at the epicenter of global trade tensions.

At the heart of this extraordinary demand is fear: the fear that, with the stroke of a pen, the luxury of owning a “made in Switzerland” timepiece could become dramatically more expensive. The specter of tariffs—potentially as high as 31% for Swiss watches—has sent shockwaves through high-end boutiques and boardrooms alike. The result? A flurry of "early shipments" and accelerated purchases as importers and affluent clients race to beat the July deadline, when tariffs could take full effect.

The Trump Tariff Factor: Policy, Power, and Perception

The latest round of U.S. trade policy turbulence began when former President Donald Trump imposed a new 10% tariff on global imports in early April. Switzerland, long a symbol of neutrality and precision, found itself targeted with a far steeper potential rate—up to 31% on its most prized exports. The implications for the luxury watch sector were immediate and profound.

While the higher Swiss-specific tariffs have been temporarily paused, their mere announcement was enough to catalyze a buying spree. The pause, extending implementation to July, is a tactical window for ongoing negotiations between Swiss and American officials. But the damage—or, for Swiss exporters, the windfall—has already been done. The anticipation of rising costs has proven just as potent a market mover as the tariffs themselves.

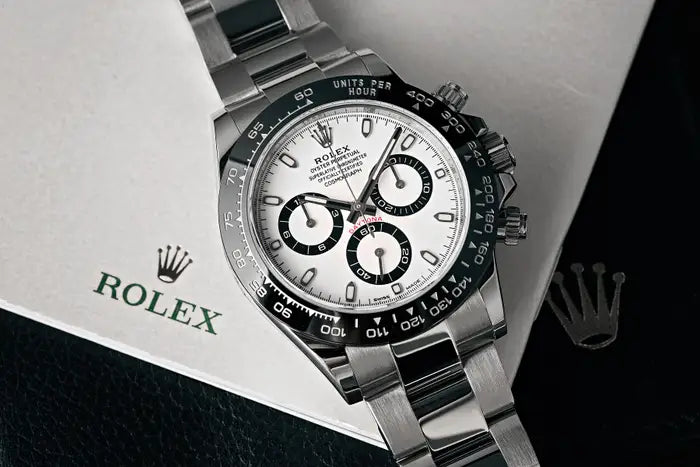

Rolex and the Rarity Premium: Why the U.S. Market Matters

Swiss watches are more than just instruments of time; they are emblems of heritage, craftsmanship, and exclusivity. To bear the “made in Switzerland” label is to assert a lineage of excellence. For American buyers—whose appetite for luxury has only grown in the face of global uncertainty—this reputation is irresistible.

- Rolex, the perennial star, remains the ultimate trophy for collectors and status-seekers alike.

- Patek Philippe and Omega continue to command loyalty among the connoisseur set.

- Newer entrants and independent maisons are also riding the wave, as scarcity drives up demand across the board.

The United States is not only the largest market for these timepieces, but also the most influential in shaping global trends. When American buyers rush to secure inventory, the ripple effects are felt from Zurich to Hong Kong. This month’s surge underscores just how quickly luxury can pivot from the slow burn of aspiration to the frenzy of acquisition.

Early Shipments, Artificial Spikes: A Cautionary Tale

Yet, beneath the glimmer of record-breaking sales lies a crucial caveat. The Federation of the Swiss Watch Industry has been quick to temper euphoria, cautioning that this is a “one-off response to an uncertain commercial situation”—not the dawn of a new golden era for luxury exports. In fact, absent the exceptional volume shipped to the U.S., global Swiss watch exports would have fallen by 6.4% in April, dragged down by a downturn in the Chinese and Hong Kong markets.

This suggests that the current boom is less a barometer of enduring demand and more a reflection of strategic stockpiling. Retailers and private buyers alike are hedging against future price increases, front-loading orders in anticipation of a more expensive landscape. The risk, of course, is that this artificial surge may be followed by a sharp correction once the dust settles and tariffs are either enacted or averted.

Diplomacy on the Wrist: Behind-the-Scenes Negotiations

The intersection of luxury and geopolitics is rarely so visible. As Swiss President Karin Keller-Sutter sat down with U.S. Treasury Secretary Scott Bessent in Geneva, the stakes could not have been higher. These talks are about more than just watches—they are a test case for how two economic powerhouses navigate the increasingly complex terrain of global trade.

It is a stark reminder that the fate of even the most exclusive luxury goods can hinge on political winds. Negotiations between Switzerland and the United States may yield a compromise that spares collectors and brands alike from punitive tariffs. Or, they may set a precedent that ripples through other sectors, from jewelry to high fashion.

Winners, Losers, and the Volatility of Luxury

For now, the winners are clear: Swiss watchmakers have enjoyed an extraordinary—if temporary—windfall, and American collectors have fortified their vaults against price hikes. But as the Swiss industry itself acknowledges, this is a distortion, not a new normal.

The losers? Potentially, the broader luxury ecosystem. When demand is pulled forward in such dramatic fashion, future quarters may see a corresponding drop, especially if tariffs do materialize. Markets like China and Hong Kong, already under pressure, could see further contractions as global uncertainty persists.

This episode also exposes the fragility of luxury’s global supply chains. Once viewed as immune to the vagaries of policy and politics, even the most elite brands must now grapple with a world where trade disputes and tariff threats can upend decades of stability overnight.

The Broader Implications: Luxury in an Age of Uncertainty

What does the Rolex rush portend for the future of global luxury? First, it reveals just how sensitive high-end markets are to policy shocks—even when those markets appear insulated by exclusivity and price. Second, it demonstrates the lengths to which buyers will go to preserve access to rarefied goods, whether through accelerated purchases or strategic stockpiling.

More broadly, this episode may serve as a harbinger for other sectors. From French couture to Italian sports cars, no segment is truly immune from the crosswinds of international diplomacy. As luxury becomes ever more global, the interplay between politics, economics, and consumer psychology will only intensify.

Conclusion: The Clock Is Ticking

As the world waits to see whether negotiations will forestall the threatened tariffs, one truth is clear: In the world of luxury, timing is everything. The current surge in U.S. demand for Swiss watches is a testament not only to the enduring allure of fine craftsmanship but also to the volatility that defines modern global commerce.

Whether this moment proves to be a blip or a bellwether depends on the outcomes of diplomacy and the resilience of both brands and buyers. For now, the message is unmistakable: When luxury is threatened, even the world's most discerning collectors move fast. The Rolex rush is on—the question is, for how long?