Explore with AI & Follow Us

The phrase “Made in China” has long been shorthand for affordable fashion, rapid manufacturing, and global supply chain prowess. But in 2025, seismic shifts in U.S. trade policy are upending this legacy, sending ripples through every corner of the fashion and retail landscape. The Trump administration’s aggressive tariff regime targeting Chinese imports has triggered legal battles, political controversy, and a dramatic rewiring of how fashion giants—and everyday shoppers—navigate a new era of retail reality.

Tariffs at the Epicenter: The 2025 Policy Earthquake

At the heart of today’s upheaval lies a bold, controversial set of tariffs squarely aimed at goods coming from China. Enacted under the Trump administration, these tariffs are not merely tweaks to existing trade policy—they represent an unprecedented use of presidential powers under the International Emergency Economic Powers Act (IEEPA). For the first time, IEEPA has been wielded as the legal backbone for tariffs, bypassing traditional, more targeted mechanisms.

This aggressive approach has cast a long shadow over fashion, manufacturing, and consumer retail, industries that have thrived on the efficiency and cost-effectiveness of Chinese production. From luxury houses to fast fashion disruptors, the impact is widespread, immediate, and deeply felt.

Legal Showdown: Courts, Controversy, and Constitutional Questions

The legality of these tariffs is anything but settled. On May 30, 2025, the U.S. Court of Appeals for the Federal Circuit issued a crucial pause in proceedings, allowing the tariffs to remain in force as legal challenges wind their way through the judicial system. The core of the dispute? Whether the administration’s use of IEEPA for imposing tariffs oversteps constitutional and statutory boundaries.

This is no ordinary courtroom drama. The Trump administration’s maneuver has set a precedent, sidestepping the more procedural and targeted requirements of laws like Section 232 (from the 1962 trade law), previously used for tariff imposition. The result is a broader, less regulated, and far-reaching impact—one that critics argue lacks the precision and oversight that trade policy demands.

The legal battle has not stayed confined to the courtroom. President Trump has responded to unfavorable rulings—particularly from Judge Timothy Reif, notably a Trump appointee—with public attacks, further politicizing what is already a charged legal saga. The spectacle has heightened scrutiny of the administration’s motives and methods, exposing deep fractures in the intersection of law, policy, and personal politics.

Fashion in Flux: How Fast Fashion Titans Are Pivoting

Perhaps no sector illustrates the real-world stakes of these tariffs more vividly than fast fashion. Digital-first platforms like Temu, which have built empires on the promise of ultra-affordable, trend-driven goods shipped straight from Chinese factories to American doorsteps, are facing an existential reckoning.

The administration’s trade crackdown delivered a one-two punch:

- Revocation of the “de minimis” exemption: Previously, goods valued under $800 could enter the U.S. from China and Hong Kong duty-free. That loophole is now firmly closed.

- Hefty new tariffs and import charges: The cost of doing business with China has soared overnight, forcing retailers to reevaluate pricing, sourcing, and shipping models.

Temu’s initial response was swift but costly. The company raised product prices and slapped on “import charges” that sometimes eclipsed the price of the items themselves. The result? A staggering drop in customer traffic and sales, as price-sensitive shoppers balked at the new math.

In a bid to salvage its business, Temu executed a dramatic pivot. The company ceased direct shipments from China and restructured its logistics to rely on locally based sellers with domestic fulfillment. The goal: circumvent the tariffs and restore the low prices that fueled its meteoric rise.

This adaptation is emblematic of a wider industry scramble. Retailers are racing to reconfigure supply chains, cultivate domestic partnerships, and rethink everything from inventory strategy to e-commerce logistics. The era of effortless, cross-border fast fashion is over—for now, at least.

Winners, Losers, and the New Supply Chain Chessboard

The consequences of the 2025 tariff regime extend far beyond any one company. For some, the disruption spells disaster; for others, it’s an unexpected windfall.

- Domestic manufacturers are enjoying a renaissance, as brands seek local partners to avoid tariff costs and shipping delays.

- Consumers face a new reality—higher prices, fewer choices, and longer wait times for the latest styles.

- Global supply chains are being redrawn, with brands exploring alternative production hubs from Vietnam to Mexico to mitigate exposure to U.S.-China tensions.

Yet, the transition is anything but seamless. Domestic infrastructure, after decades of offshoring, is ill-equipped to absorb a sudden surge in demand. Sourcing alternatives often come with their own geopolitical and logistical complications. The industry is learning, in real time, that there are no easy substitutes for the scale and efficiency that China has long provided.

Political Theater: Trade Policy as Power Play

Trade policy has always been as much about politics as economics, but the 2025 tariffs have elevated this dynamic to new heights. The administration’s willingness to upend established norms—and to attack judicial independence when challenged—has made tariff policy a proxy for broader ideological battles.

Critics charge that the tariffs are blunt instruments, lacking the focused intent and procedural safeguards of past measures. Supporters argue that decisive action was overdue, and that the long-term benefits of recalibrating America’s relationship with China outweigh short-term pain.

Regardless of where one stands, the drama highlights a central truth: fashion, retail, and manufacturing have become inextricably linked to the shifting tides of global politics. Industry leaders must now be as versed in international law and diplomatic maneuvering as they are in design and logistics.

What Comes Next: Uncertainty, Innovation, and the Future of “Made in China”

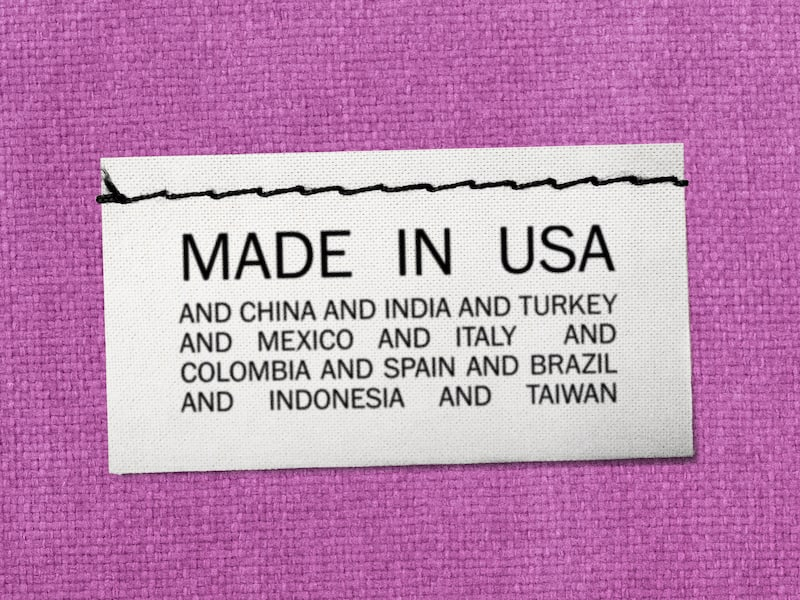

As the legal battle continues and the political rhetoric intensifies, one thing is certain: the landscape for fashion and retail will never be the same. The “Made in China” label, once a guarantee of affordability and accessibility, now carries new connotations—of legal risk, political controversy, and economic uncertainty.

Yet, amid the turmoil, there is also opportunity. Brands that can innovate—whether by localizing supply chains, embracing transparency, or reimagining value for the consumer—may not just survive, but thrive in the new era.

For now, the industry holds its breath, watching the courts, the White House, and the world’s production lines. The only certainty is change, and the next chapter in the global story of fashion is being written with every headline, every shipment, and every bold pivot.

Conclusion: Fashion’s New Reality Check

The tariffs of 2025 have jolted fashion out of its comfort zone, exposing the sector’s deep interdependence with global politics and legal frameworks. As legal and political battles rage on, the industry must reckon with a new reality—one where adaptability, resilience, and strategic acumen are as essential as style itself.

Whether this moment proves to be a correction, a catalyst, or a cautionary tale remains to be seen. What is certain: the world of “Made in China” will never look quite the same again.

Explore with AI & Follow Us